Brexit: how will Seabase deliveries work from 1st January 2021

From 1st January 2021 here is how orders within the EU are processed:

- seabase.eu ships from the UK.

- Customers outside the UK pay prices excluding VAT.

- To tell the website you should not pay VAT simply select the correct country under the ‘Pay Now’ area of the site.

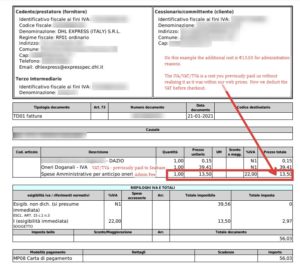

- DHL/FedEx/TNT will ship to you and send you a message to say your parcel is being cleared by EU Customs – this is sometimes done before it leaves Seabase to save you delivery time.

- EU Customs will re-charge you the VAT that we did not charge you. However that VAT will be at your country’s prevailing rate. Customs or DHL/UPS/FedEx/TNT etc. may charge you a small administration fee for this service which is normally around 14 euros. Seabase has no control of your local country’s clearance fees or VAT rate.

- If you are VAT registered in your home country then of course this is no cost to you.

Example customs import costs to Italy

Do products cost you more after Brexit?

It depends – the pricing is pretty much the same. The UK VAT rate is 20% and this is what you used to pay. EU countries have VAT rates between 19% and 25% so you may pay a little more or a little less VAT when your order arrives. The clearance fee charged by your country is a fee we do not have control over – this varies. For example in the UK this fee can be negotiated with the shipping country.